Life Insurance in and around Spearfish

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

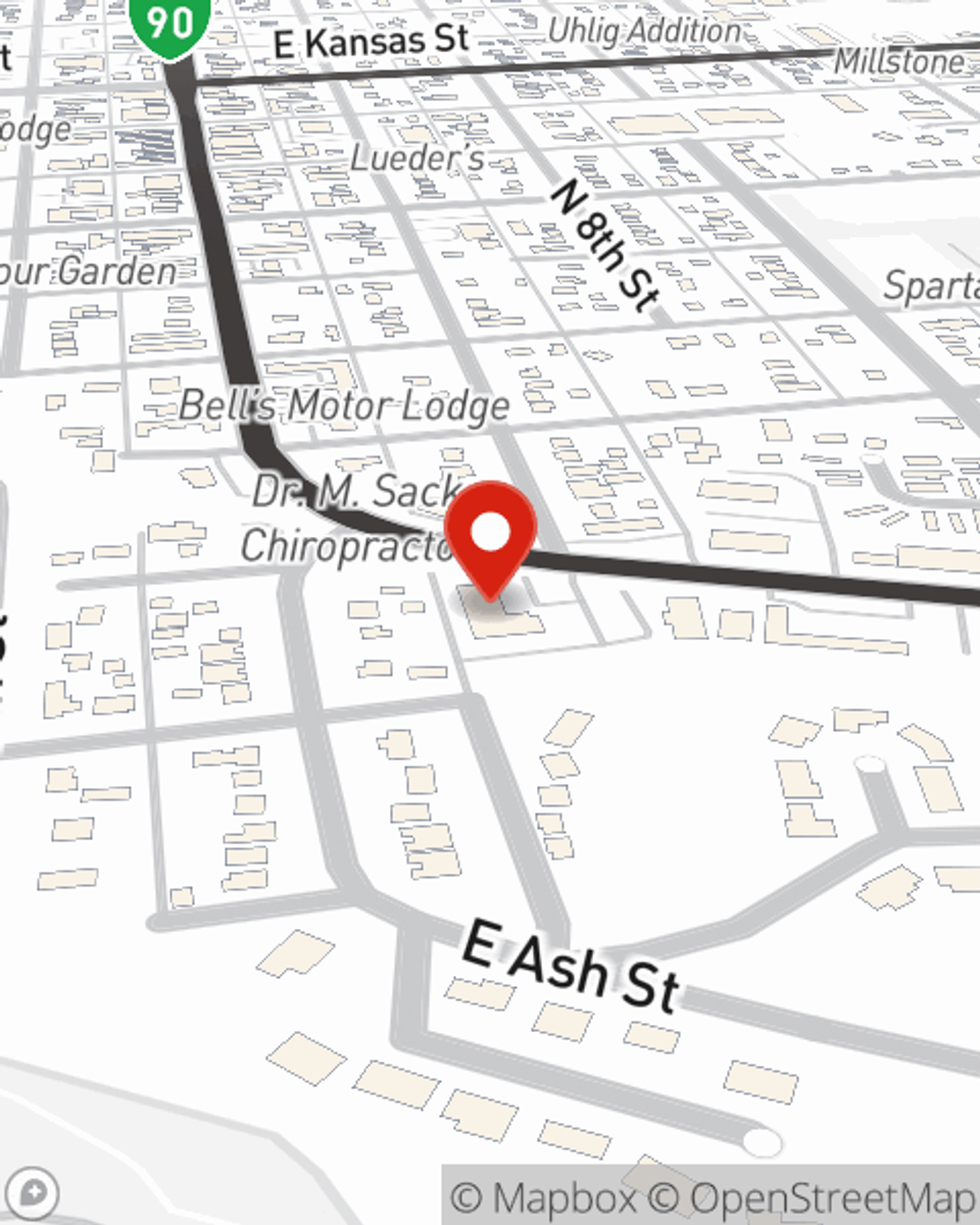

- Spearfish

- Whitewood

- Sturgis

- Box Elder

- Sundance

- Beaulah

- Belle Fourche

- Sommerset

- Deadwood

- Lead

- Rapid City

- Piedmont

- Black Hawk

- Lawrence County

- Butte County

- Pennington County

It's Never Too Soon For Life Insurance

One of the greatest ways you can protect your loved ones is by taking the steps to be prepared. As uneasy as thinking about this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Get insured for what matters to you

What are you waiting for?

Love Well With Life Insurance

The beneficiary designated in your Life insurance policy can help cover bills and other expenses for the people you're closest to when you pass. The death benefit can help with things such as childcare costs, home repair costs or grocery bills. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, reliable service.

Don’t let worries about your future make you unsettled. Call or email State Farm Agent Coreen Lerwick today and see how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Coreen at (605) 642-8141 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Coreen Lerwick

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.